This week, Glasgow will act as official host to the ‘Conference of the Parties’, or COP26, delegations. The goal is to secure global net zero by 2050 and keep the world to within 1.5C of warming. Developed countries will be asked to deliver on their promise to raise $100bn a year for those most vulnerable to climate change.

In 2021 alone, we have seen intense rainfall cause extensive flooding in Germany and New York, snow in Madrid, cyclones in Fiji, winter storms in Texas, the worst sandstorm in a decade in China, a heat dome over Canada, and wildfires burning out of control in Greece and Turkey. There is a recognition that we are living in a ‘Code Red’ status, and doing nothing is no longer an option.

So, what is Net Zero, and why 2050? Essentially, it is an ambition to be carbon neutral: remove as many emissions from the atmosphere as we create. What we do to achieve net zero will have a major impact on the world in which we live, reaching every corner of the economy and requiring businesses to get on board.

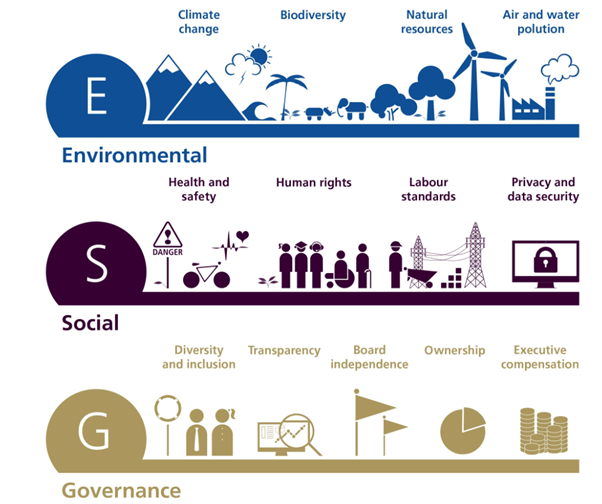

Over the last 18-24 months, we have seen the emergence of the term “ESG”. This is a system for how to measure the sustainability of a company, or investment in three specific categories:

E – Environmental criteria focuses on waste and pollution, depletion of natural resources, carbon emissions, deforestation.

S – Social criteria concentrates on employee relations, workplace diversity, working conditions (eg. child labour and slavery); helping local communities, or funding projects which help reduce poverty and improve conditions.

G – Governance examines how a corporation polices itself, what its tax strategy is, how its executives are remunerated, the donations it makes and who it lobbies, whether it partakes in bribery or corruption, and the board’s structure and diversity.

These concepts are not overly new – sustainable and ethical investing have been around for many years. However, as our consciences have been pricked by what we witness day to day, and through the wisdom of celebrated personalities – such as David Attenborough and the Swedish activist Greta Thunberg – our interest has been piqued and sustainable investing, once considered niche, has become mainstream.

Superficially, the chances of COP26 succeeding appear high. The US, China, EU and UK, along with 97 other countries, have all stated that by mid-century their overall emissions of carbon dioxide will be zero. The economics are aligned: coal, oil and gas companies are increasingly poor performers, whilst renewable companies are booming. Realistically, such is the global divide, the chances of compromise are limited and so should we be surprised if another summit is required? Even if there are no celebratory handshakes or a general consensus at the conclusion of COP26, asset managers, financial planners and investors are becoming more aware of their responsibility and need to do more.

In client discussions, we have experienced an increasing interest in wishes to adopt sustainable investment solutions. The interest is not limited to any specific generation. All have their own reasons from “it’s the right thing to do” to “seeing it as a longer term investment opportunity”. Allocating capital towards companies that are positively contributing to addressing the world’s sustainability challenges can be a driver of change, whilst also helping to meet investors’ financial objectives. Helping clients understand what they desire is critical to the fact finding process. A simple question such as “Are you happy for your pension or investments to contribute towards climate change?” usually provokes an emotive reaction.

If you would like to get involved in tackling the climate crisis through sustainable investing, an Integrity365 adviser will be more than happy to assist and provide you with more information. Get in touch today on 0117 450 1300.