Keep Calm and Remain Invested: Words of Wisdom for Times of Market Volatility

When investment performance is poor, as it has been throughout much of 2022, it can be difficult to ‘keep calm and carry on’ by remaining invested. Sometimes, our human instincts tell us to cut our losses and get out now before it drops even further. However, no matter how unnerving it is to see stock market volatility, knee-jerk reactions such as exiting the market could prove costly.

Market volatility is running high across the board right now, causing even the more experienced investors to question whether they are doing the right thing. It can be tempting to make a sudden change to your investment portfolio in order to try and ‘stem the losses’, but giving into fear can cost you dearly. If we look at historical data, it suggests that time in the market – as opposed to trying to time the market – is the key to investment success. So, what should you do when market volatility hits?

1. Think About Your Future

If it is long-term growth or a long-term income you aim to achieve in your investments, it is not wise to make any rash decisions due to short term drops in value. History has shown that the best periods of stock market performance often follow a period of volatility, therefore by cashing in at the bottom you are likely to miss out on the recovery and the growth that would be associated with it thereafter.

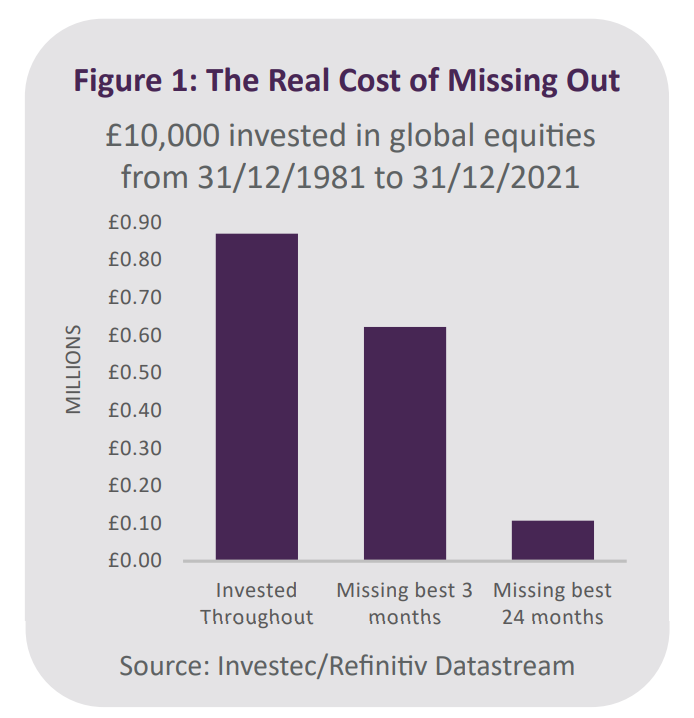

Investec have recently explained this well by illustrating the impact of the 1981 recession and how missing out on small periods within investment markets can have a significant impact on your end goals. They explained that if you invested £10,000 in global equities on 1 January 1982 it would be worth £870,129 some 40 years later. However, if you missed out on the best three months in that period then your investment would only be worth £621,964. Furthermore, by missing out on the best 24 months it would be significantly lower at just £107,420 (see figure 1).

2. Tune Out The Noise

We have seen a lot of negative, attention-grabbing headlines in the news recently, however, please remember that many news outlets will tend to capitalise on the doom and gloom during periods of market volatility for the purpose of media attention.

Be careful where you are getting your information from, and remember that Integrity365 work with industry experts to provide you with the most up to date monthly market commentary to let you know what is going on in the financial world.

3. Set Realistic Expectations

After previous stock market crashes, there has always been a recovery period to follow, and there is every reason to expect the same will happen again, but it can take time. Market volatility combined with lower returns are likely to be with us for some time yet, and so it is wise to remember this moving forward and manage your expectations in the near term.

The key to ensuring you benefit from this recovery and any associated growth is by remaining invested during this time. For example, in the stock market crisis of 2008, it took 4 years for markets to recover. However, bear markets (when there is a drop of at least 20% for 60 days or more) on average tend to last less than a year.

4. Limit Portfolio Checks

It may be tempting to continuously check your portfolio values during this worrying time, however, try not to do so too often. This is likely to cause more stress and negative emotions in an already difficult period. Not only can this have a knock on effect to your ability to work and concentrate on daily tasks, but when emotions are running high it may prompt you to make a rash decision that could negatively affect your investment performance over time.

5. Review Your Goals

Perhaps during this time your circumstances have changed and there may be alterations you need to make as a result. It is important to regularly review your financial arrangements to ensure that these meet your current objectives. Where investing is concerned, do not forget that this also involves your investment preferences and your attitude to risk.

6. Seek Advice

We understand that these are difficult times, and if you are concerned in any way please remember that we are always here to help. It may ease your worries by talking it through with your IFA, and there may be changes that we can identify to help alleviate your stress.

The key to giving your portfolio the best chance of recovery, especially during these times, is diversification and professional fund management. If your funds are invested across a range of assets, countries and sectors, as well as being looked after by professional fund managers who are the first to know about what is going on in the markets, your portfolio will have the best chance of benefiting from that eventual growth.

If you have any questions or would like to discuss your own investments, please do not hesitate to get in touch with an Integrity365 Independent Financial Adviser on 0117 450 1300.