Following the announcement by government of the abolition of the £1,073,100 pensions Lifetime Allowance (LTA) – which was then ratified in legislation and received Royal Assent in July 2023 – many have been wondering how this will affect their own circumstances moving forward.

What has changed?

There are three key changes to note in this update. Firstly, the Lifetime Allowance tax charge of 25% excess income / 55% excess lump sum have been removed.

Secondly, the current Lifetime Allowance of £1,073,100 has been effectively removed since April 2023 and will be officially changed from April 2024, meaning pension holders are able to fund/withdraw from their schemes above this amount without having the above tax charges applied.

And lastly, tax-free cash is now based on a cumulative monetary amount rather than a percentage. Therefore, income from a Defined Benefit plan is now no longer included as part of LTA calculations when equating available tax-free cash.

How does this affect LTA protection?

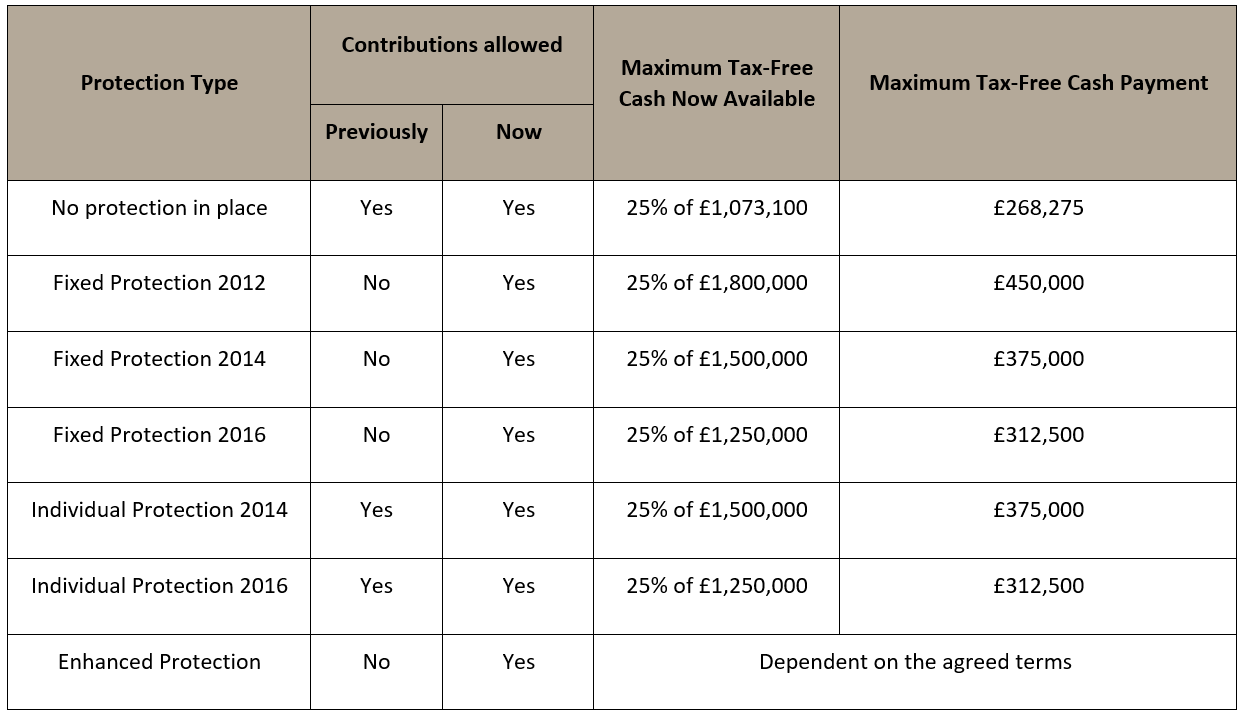

There have been various LTA protections available to investors due to multiple changes to it since it was introduced in 2006. The table below details what you could hold and how this is affected.

What could change in the future?

The rules and regulations surrounding the LTA changes still lack clarity. For example, how the Defined Benefit system will be affected due to the way it interacts with the LTA is unclear – however, this will also depend on the rules implemented by scheme Trustees.

There is also uncertainty due to the upcoming UK election – to occur no later than 28th January 2025 – as Labour could stick to their pledge to overturn the legislation – which was implemented by the sitting Conservative Government – if they come into power.

At this time we await further guidance and detail from the government to explain some of the holes within the current plans announced, before we can fully understand the impact to all clients. If you have any questions regarding these changes, please do not hesitate to contact an Integrity365 Independent Financial Adviser on 0117 450 1300.