How well do you understand how your pension is taxed? You may not be aware of this, but there are different ways in which a pension can be taxed and there may be a more tax-efficient method than what your current pension is using.

There are two ways you can get tax relief on your pension contributions; relief at source and net pay. If you are in a workplace pension, your employer chooses which method is used, however, if you have a personal pension the relief at source method is always used.

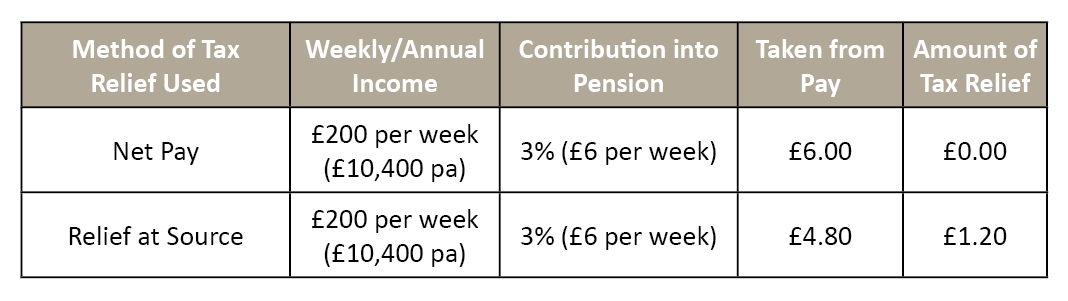

The table above shows a comparison between the two methods, and the effect that this can have on your take-home pay.

While both methods would put £6 into your pension, with net pay the full £6 is taken from your pay and you cannot claim any money back from HMRC. Whereas, with relief at source, your take-home pay would be slightly higher as only £4.80 is taken from your pay, and the rest of the £6 contribution is made up from tax relief.

Depending on the rate of tax you pay, it may be that you need to claim extra tax relief not claimed by your pension scheme, either through self-assessment or by contacting HMRC.

There are, however, certain limits that you need to be aware of which can impact the amount of tax relief you are entitled to, which is known as the Annual Allowance. Contributions in excess of these limits could lead to a tax charge on any excess relief provided.

Company owners can also make employer-based contributions in to their pension plans. This can lead to lower corporation tax relief within their business, but any tax relief is subject to the discretion of the Local Inspector of Taxes.

You can read more about pensions and tax relief later in this issue in another recent article, Tax Relief, Allowances and Your Pension.

If you have any questions about your pension and wish to speak to an Independent Financial Adviser, please do not hesitate to get in touch on 0117 450 1300.