Have you thought about pausing your pension contributions to save money during the cost-of-living crisis? Before you do, Craig Pritchard shares some key points to consider.

It is hard to talk about money at the moment without mentioning the cost-of-living crisis and the impact it is having on individuals, businesses, employers, employees – in fact, there are very few people that it is not affecting in some way. Likewise, your pension is not immune to cost-of-living crisis either.

As the economy has been greatly impacted, many people are wondering how their investments may be affected as a result. Another big concern is affordability, and how this will affect the amount of money you may have to retire on, and therefore the living standard or lifestyle you will have in retirement.

When we come into periods such as this where many are feeling a financial strain, people often look to reduce their spending in order to increase their level of disposable income. It is a good exercise to sit down and work out how much money you have coming in against your monthly expenditure to identify any costs that you could cut. For example, there may be monthly subscriptions you do not need, or memberships that you are no longer using.

Remember, when you stop saving into your pension…

- Your employer contributions stop.

- You miss opportunities for added potential growth.

- You may forget to start again!

As part of this exercise, some people may be tempted to pause their pension contributions as they are more focused on their current needs than their income at retirement.

Whilst this is a completely personal choice, we strongly suggest that you take a long-term view on all investments, and pensions are no different. However, if you are seriously considering this as an option, it is important to think about how this may affect your future and what you may be missing out on as a result.

Resuming Your Saving Habits

Firstly, if you do stop saving into your pension it can be very difficult to then resume your contributions. Whether you forget about it, put it off for too long, or fear reducing your income, it could prove quite challenging to get back into once you have stopped.

Although, a good point to note is that – as part of Auto Enrolment regulations – you are automatically enrolled into your employer’s workplace pension scheme every three years, in line with their pension duties.

Therefore, once you have stopped saving you will eventually be re-enrolled, however, this could be as long as three years down the line, depending on where this happens within your employer’s Auto Enrolment requirements.

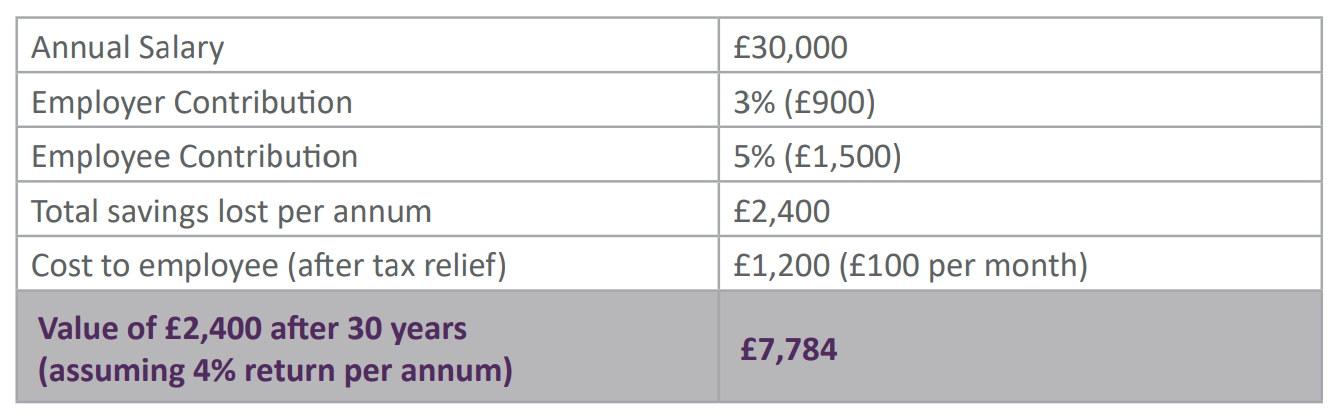

Example of what you could potentially miss out on:

Employer Contributions

It is also important to consider any additional benefits you will be missing out on if you opt out of your workplace pension, including your employers’ contributions.

For example, based on the scenario in the above table, if you were earning £30,000 per year with an employer contribution of 3%, you would be missing out on an additional £900 from the business each year that you do not save into your pension.

Missed Opportunities for Growth

Furthermore, your pension is an investment which will grow over time and therefore you will see less of a return on this as it grows if you stop saving into it. Based on the example above, this individual would be missing out on £7,784 in their pension pot for simply stopping their monthly contributions for one year.

Obviously, this is a significant amount of money that could be missed out on and so this is why we would strongly encourage remaining invested in your pension during this difficult period to ensure you have the provisions you need at retirement.

That being said, we do understand that this is an incredibly difficult time for many people, and it may be that you need to make this hard decision to stop your pension contributions for the time being in order to meet your other financial obligations. However, we wanted to highlight that this is not a decision to be taken lightly and ensure that you understand the impact this may have on your financial future.

If you wish to discuss your pension plans or any concerns you have in these difficult times, please do not hesitate to get in touch with an Integrity365 Independent Financial Adviser on 0117 450 1300.