Did you know that there is a limit to how much of your estate you can give away? Many people are not aware of the long list of allowances and rules when it comes to gifting assets, which actually takes a lot of careful planning to do so tax efficiently.

The first step in Inheritance Tax planning is to know what you have, who you would like to pass it to and ensure any wills or Lasting Power of Attorneys (LPAs) are up to date. From this point, we can look at ways to further reduce your estate in later life to avoid a hefty Inheritance Tax (IHT) liability upon death, whilst still leaving adequate income for yourself in retirement.

My clients Mr and Mrs Jones (aged 68 and 64 respectively) were in this situation, after building a comfortable lifestyle with an income derived from rental properties, pensions, and investment pots, as well as having sold a business 7 years prior. The couple’s estate – with an overall value of approximately £3m – would be passed on to their 4 children, and ultimately 6 grandchildren. If they were to pass away with their estate in its current state, this would result in a tax bill of circa £940k (40% of the excess of their combined £650k allowance). In order to avoid such a large tax bill and allow more to be passed on to their chosen beneficiaries as they wish, I was able to help them put a range of plans in place to reduce this amount.

Reducing the Estate

The family home – worth £1m – would be jointly left to their children in their will upon the second spouse’s death. After planning, this would allow the residence nil rate band (NRB) to be used again (an additional, joint £350k allowance), as further planning reduced the estate to below £2m, therefore increasing their Inheritance Tax allowance to £1m.

As mentioned, Mr and Mrs Jones also owned a rental property, which they decided to sell and gift the proceeds into Junior ISAs to their six grandchildren, using the annual allowance over future tax years to further reduce their estate.

They could also help their family now by paying for their grandchildrens’ school fees by gifting £10k per annum, which was covered by the out-of-income exemption.

The couple also gifted £400k, from their joint savings into Trust Funds, for their four children which, after 7 years (as per the 7-year-rule) would be considered a ‘potentially exempt transfer’ if they were both still alive at that point and fall out of their Inheritance Tax calculations.

Income at Retirement

Cash savings were used to invest into a Discounted Gift Trust (£600k) in Mrs Jones’ name due to her better state of health (after underwriting this gave a 50% immediate discount, which effectively reduced their estate value by £300k on day one, then tapered £300k over the next 7 years). This provided an income of £24kpa for the remainder of Mrs Jones’ lifetime (tax efficient on the first 5% for 20 years).

Two of their current £100k ISA portfolios were also transferred to AIM investment funds – which are exempt from IHT after 2 years but still accessible should they require the funds later in retirement. The value of these will be subject to market fluctuations relative to an AIM portfolio. Further investments were made with NS&I Premium Bonds of £50k each, where interest is paid as monthly tax free ‘prizes’. The couple also had an investment portfolio of ISAs, Unit Trust/OEICS and Offshore bonds which totalled £400,000 of available funds within their estate.

We also set aside an emergency fund in cash £50,000 as well as £75,000 within their deposit account for expenditure, leaving plenty for a comfortable lifestyle both now and at retirement.

IHT Liability

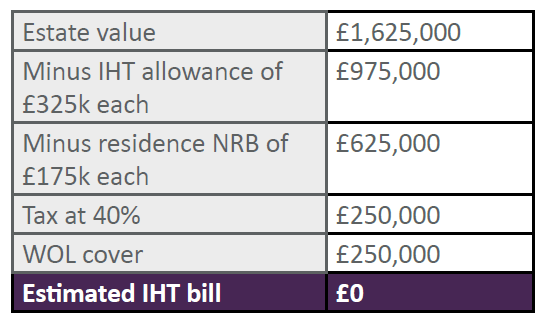

After survival for 7 years the various Trusts and gifts fully benefit from the planning completed, as their estate was valued at circa £1,625,000 instead of the initial £3m.

However, planning did not stop there. By putting a Whole of Life Policy in place and in trust to pay-out to their children, this would offer £250k upon the death of the second spouse, they could provide further tax savings and allow more of their estate to be passed on still:

As you can see from this example, there are huge savings to be made with careful IHT planning, and so many different exemptions and allowances that can be implemented in order to do so, depending on your individual circumstances. If you would like to discuss your estate planning needs, please do not hesitate to get in touch with an Integrity365 adviser on 0117 450 1300.

For more information on Estate Planning, download our PDF guide: